The U.S. Securities and Exchange Commission has halted an initial coin offering and charged its founders with “orchestrating a fraudulent initial coin offering,” the regulator said Monday night. The agency said it charged Sohrab Sharma and Robert Farkas, the co-founders of Centra Tech, with fraud after they raised $32 million by selling “unregistered securities.”

Alibaba Group Holding Ltd on Monday sued a Dubai-based firm it said has caused confusion by using its trademarked name to raise more than US$3.5 million in cryptocurrency known as “Alibabacoins.”

Given bitcoin’s meteoric rise in 2017, and persistent slump this year, it’s easy to wonder just how much the digital currency is really worth. Their analysis “indicates current support levels for the bitcoin market in the range of US$22-US$44 billion, at least four times less than the current level,” the researchers said, according to a March 29 MIT Technology Review article.

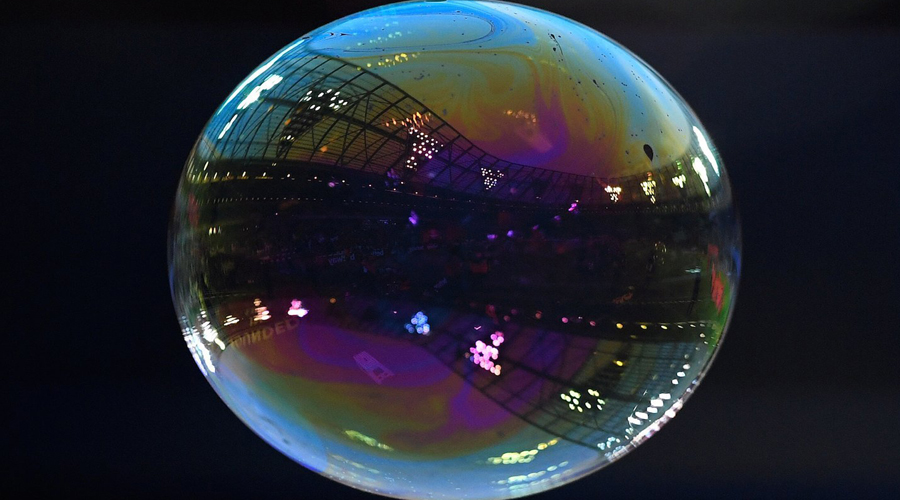

Bitcoin has more than halved in value this year, leading critics to say it’s in a bubble that’s deflating. Jon Matonis, the cofounder of the Bitcoin Foundation, says the real bubble is in bond and stock markets. Matonis thinks that we’re entering a “post-legal-tender age” and that it’s great that big banks are getting interested in crypto.

Amber Baldet, who oversaw development of JPMorgan’s permissioned blockchain platform, Quorum, is leaving the financial institution, according to an internal memo sent Monday by the bank’s head of blockchain initiatives, Umar Farooq.

The South Korean city of Seoul is developing its own cryptocurrency – the “S-Coin” – to be used in city-funded social benefits programs, says its mayor. Mayor Park Won-soon announced the plan during an interview with CoinDesk Korea last week, where he also revealed that the city will create a fund to support the advancement of blockchain technology and related startups.

Chinese petrochemical giant Sinochem Group has succeeded in utilizing blockchain technology to carry out a gasoline export. The trial shipment was completed by the group’s subsidiary, Sinochem Energy Technology, and traveled from the Chinese city of Quanzhou to Singapore, Xinhua said on Monday.

On April 1, 2018, a day known as April Fools’ Day, Vitalik Buterin published Ethereum Improvement Proposal (EIP) 960 to limit the supply of ether (ETH) to 120,204,432 — twice the amount issued in the project’s presale in 2014.

___

Disclaimer. This article/email is for informational purposes and should not be considered investment advice. Statements and financial information on Nami web/email and Nami related sites do not necessarily reflect the opinion of Nami and should not be construed as an endorsement or recommendation to buy, sell or hold.

While we aim at providing you all important information that we could obtain that may include certain information taken from exchanges and other sources from around the world, readers should do their own research before taking any actions and carry full responsibility for their decisions.Trading and investing in digital assets like cryptocurrencies is highly speculative and comes with many risks. Past performance is not necessarily indicative of future results.

Nami may provide links to third-party websites, including social networking websites. Since we do not control third-party sites and are not responsible for any information you may provide while on such sites, we encourage you to read the privacy policies on those websites before providing any of your information on such sites.