Nami would like to announce that new product – Nami Futures has been released on iOS, Android and Web base today.

Nami Futures is a trading platform for Crypto Future Contracts, focusing on Bitcoin Futures Instrument. Nami Futures provides trading margin products with leverage upto 1:100. Nami Futures connects with Bitmex to get liquidity provided. All orders on Nami futures can be processed and liquidated easily as Bitmex’s liquidity is around 1.5 billion USD.

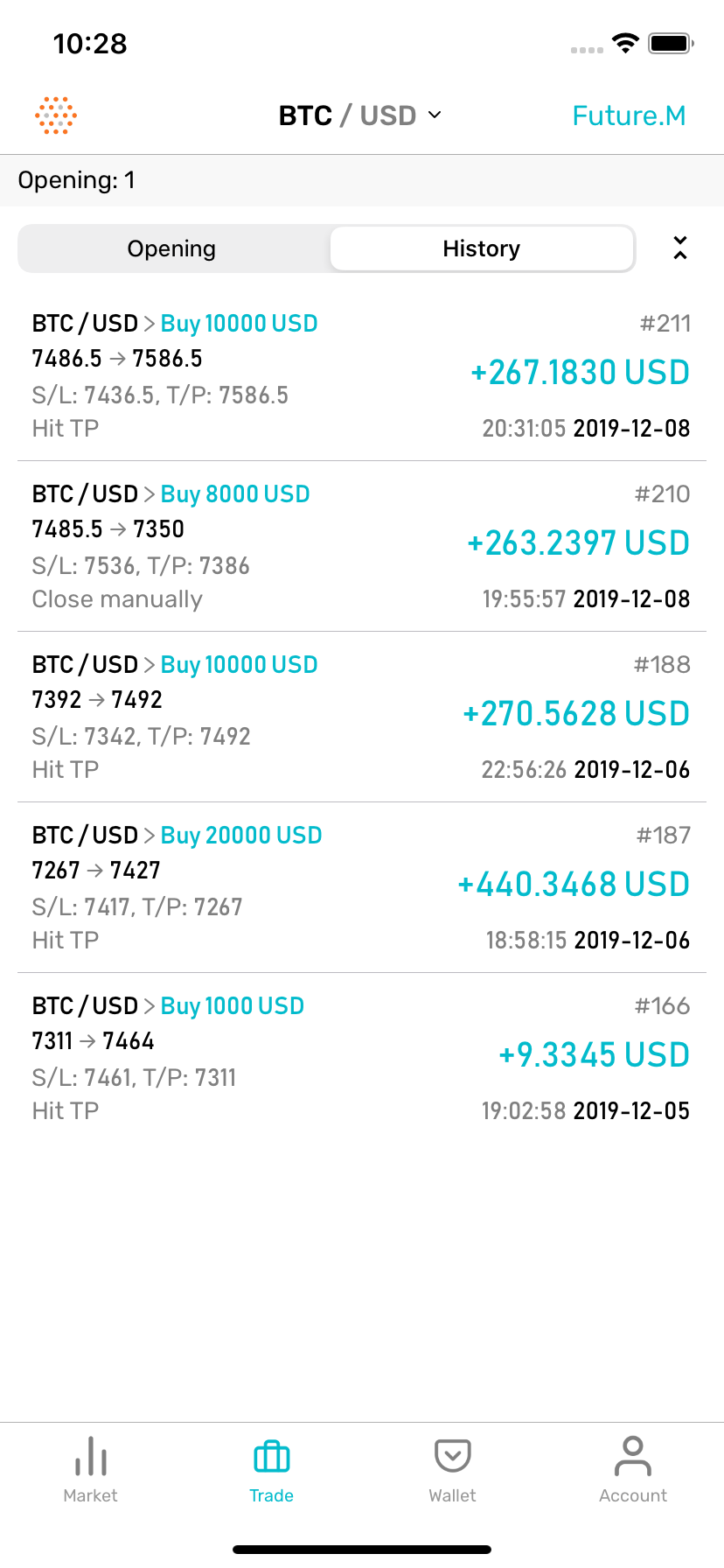

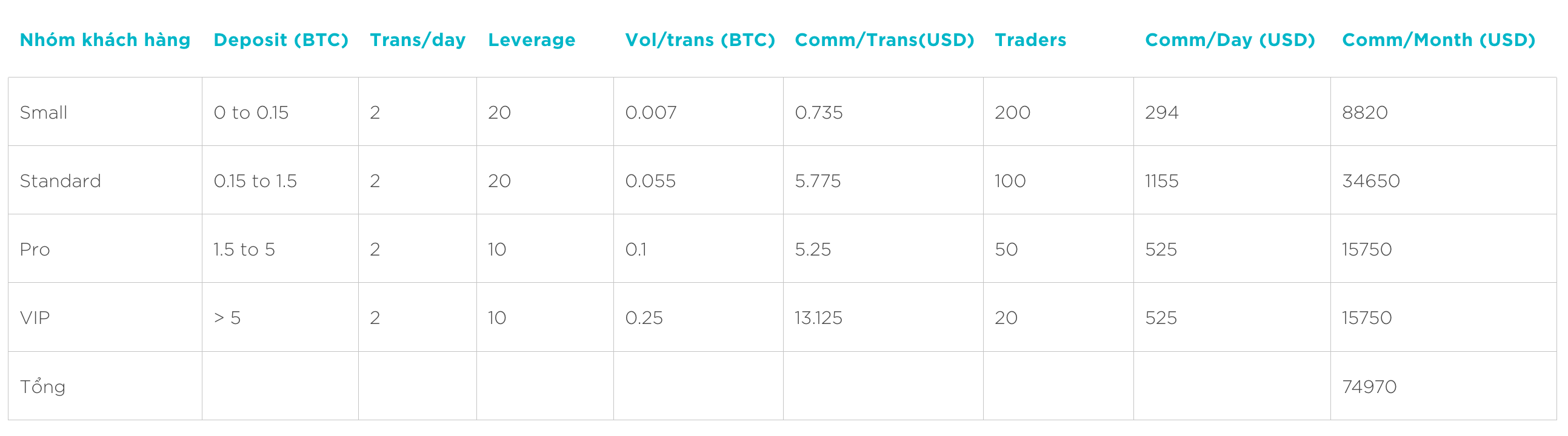

Users will get commission upto 25% – 35% for each orders/transaction from the users who are under their referral lines. Nami pays commission to you for your presenting and contributing to the development of the Platform.

Volume (BTC) = Margin * Leverage

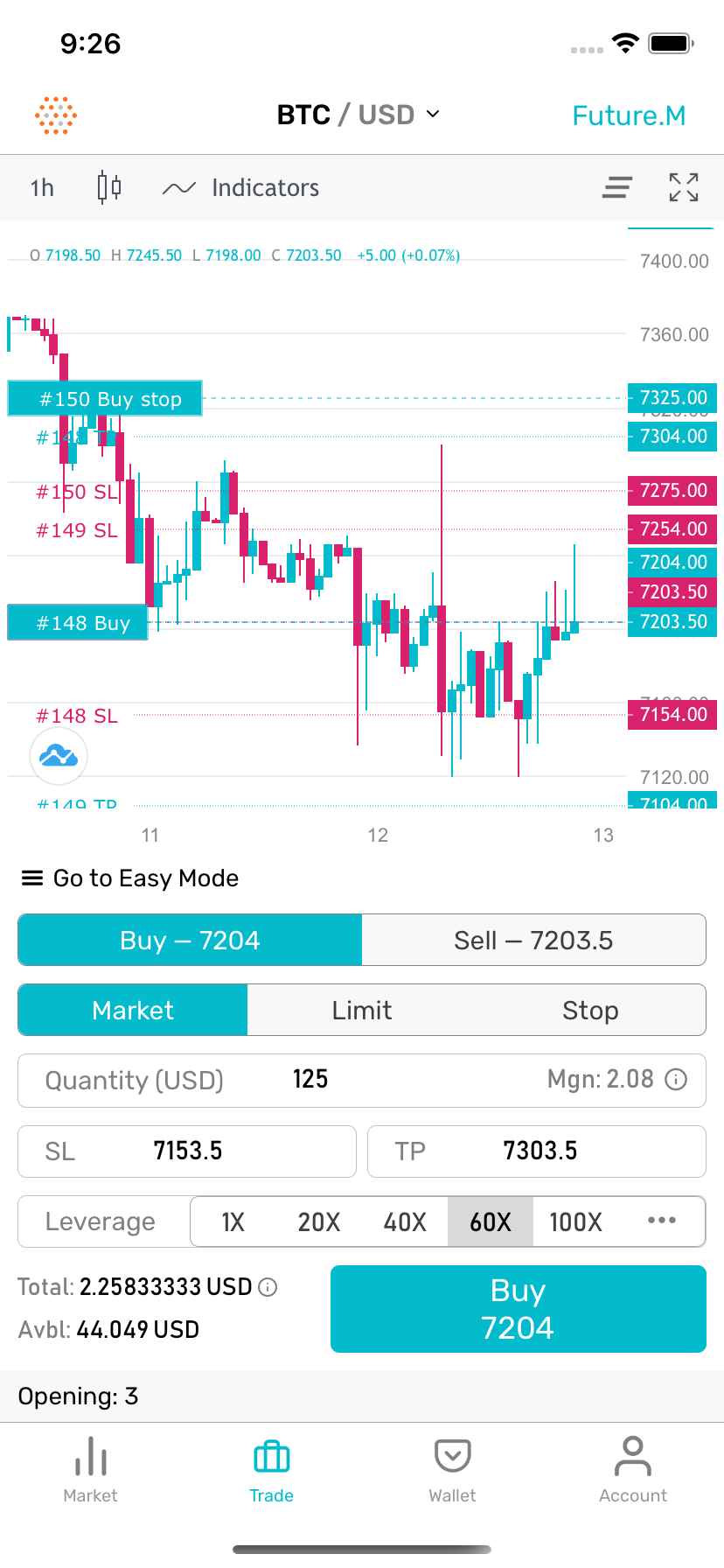

Quantity: is the number of contracts that users buy/sell based on specific leverage. For example, user decides to open an order of 1000 Quantity at leverage of 100; margin used will be 1000/100 = 10

Mgn: stands for Margin and is calculated as follow Margin = Quantity / Leverage

Limit: is an order to buy or sell for a specific price that you want. For example, current BTC price is 7100 and user wants to buy when the price is 7000 => He/she will open a Buy Limit at 7000.

Stop: is an order to buy or sell when the price is over a specific price that user set before. For example, current BTC price is 7100 and user wants to buy when the price reaches 7200 => He/she will open a Buy Stop at 7200.

Stoploss: is an order to close a position at a specific price that user set as a maximum loss he/she can bear in order to control and limit loss.

Take Profit: is an order to close a position at a specific price that user set as an exiting point in order to protect their profit.

Liquidation Price: is the price at which your position is liquidated. The higher the leverage is, the closer liquidation price is to your opening price. Liquidation price is determined by Bitmex as Nami transfers all orders to Bitmex in order to ensure liquidity and protect users’ benefits.

Swap: is the fee for opening order overnight (24h). Swap will be calculated by 0.048% of Quantity (0.002% per hour)

Download Nami Futures app on

iOS : https://apps.apple.com/us/app/nami-exchange/id1480302334

Android : https://play.google.com/store/apps/details?id=com.namicorp.exchange

Or visit website : https://nami.exchange/future/XBTUSD

______

About Nami Corporation

Nami Corp. is a global FinTech company working on Investment and Technology based on Blockchain. It’s not just a single platform, we have created the whole Ecosystem to help Contributors and Traders around the world to utilize their experience and their money with the slogan “Change mindset, make giant steps”.